Los Angeles-based private equity firm Marlin Equity Partners has announced the close of its take-private acquisition of technology lifecycle management (TLM) solutions provider Tangoe, Inc. The global investment firm will combine the Orange, Connecticut. -based firm with its existing portfolio company, Asentinel LLC.

In merging Tangoe’s market share and scale with Asentinel’s performance and automation capabilities, the private equity firm hopes to create a strong new leader in the next generation TLM solutions space with over $38 billion of spend under management and 1,300 customers. Enterprises will continue to leverage Tangoe’s software and services in order to manage and optimize spend across multiple IT categories, aided with visibility into the complex processes associated with their assets and expenses.

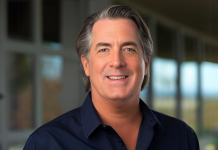

As part of the deal, enterprise software industry veteran Robert Irwin will serve as Chief Executive Officer, taking the place of Jim Foy, who stepped in from the board to lead Tangoe through the last year. Irwin bring to Tangoe over 30 years of experience in the technology sector, having served as CEO of EMS Software, TDCI and Sterling Commerce.

The combined entity will operate under the Tangoe brand and be headquartered in Parsippany, New Jersey. Marlin’s acquisition was made through a tender offer for all of the outstanding shares of TNGO common stock at $6.50 per share, followed by a second-step merger. The purchase price reflects a 35% discount to the stock’s IPO price of $10 per share when it hit the Nasdaq in 2011.